Questions Our

Customers Ask Most.

Need Answers? Find Them Here!

ASA is a Master General Agency. We have been dedicated to the international insurance market since the 1990s. We represent the most reputable insurance companies in the market who have solid financial backing and quality coverage. In fact, our employees and their families abroad are insured with the same products we offer to our customers.

We focus strictly on international insurance. This allows us to put all our efforts and resources into providing you with protection that covers only what you need while traveling or living abroad.

No, we do not charge you a fee for our service. The premiums stated are set forth by each individual insurance company.

Yes, we provide insurance to people visiting the United States or moving permanently. Please contact us for more details.

Yes, we provide insurance to groups or companies of any size who are either traveling or working abroad. Please contact us for more details.

With any of the products under the “travel insurance” link, you are able to receive a quote, apply for coverage, and receive your confirmation of coverage instantly online. There is little to no wait time for your documents to be emailed or processed.

Yes, once you have applied and been approved by one of our plans, we will be happy to send you the appropriate letter. The letter is specifically designed to meet the requirements of the consulate, so you may obtain your Visa.

In most cases a policy purchased to cover you in the United States will not provide any coverage abroad or is extremely limited coverage. Please check with your insurance provider to determine their coverage outside the United States. Be sure to obtain confirmation of your coverage in writing from your insurance provider.

Generally, your current domestic insurance policy does not provide coverage abroad.

If you are traveling, living, studying, or working abroad in an international location, international insurance will provide the benefits and coverage you need.

With the enactment of the Schengen Agreement, traveling to one or more countries within Europe became much simpler. Not only did the agreement eliminate the need for passport and other border controls within the Schengen area, the medical insurance requirements are the same for each country. When traveling for business, study, or tourism for a stay of up to 90 days in a 180-day period to one or more of the 26 Schengen countries (listed below), proof of medical insurance must accompany your Visa application and meet, at a minimum, the following criteria:

- Medical coverage of at least €30,000

- Emergency medical evacuation

- Repatriation of mortal remains to your home country

- Coverage for the entire duration of your stay

One of the most common reasons Visa applications are denied is the lack of compliant medical insurance. All of ASA’s medical insurance plans are from A rated insurers and exceed the requirements of the Schengen Visa. Our plans feature deductibles from $0 to $2,500 and coverages ranging from $50,000 to unlimited. As soon as you select your plan and your purchase is complete, you will receive a confirmation email that contains a link to print your Visa letter, which must accompany your Visa application.

For more than 20 years, ASA agents have specialized in finding the most economical medical insurance plan to meet all legal requirements. International insurance is our only business, and our mission is to give you quality protection around the world.

Schengen countries: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Benefits and coverage vary by plan. Most include coverage for:

- Outpatient medical expenses (doctor visits, x-rays, lab work)

- Hospitalization expenses (room & board, surgery, anesthesiologist)

- Intensive care

- Emergency room

- Prescription medication

- Emergency evacuation

- Repatriation of remains

- Accidental death and dismemberment

- Pre-existing conditions

- Maternity

- Acts of terrorism

- Trip interruption/cancellation

We offer affordable plans for visitors to the U.S. that are specifically designed to meet or exceed requirements of J-1 Visa. Learn more information about U.S. Visitor Insurance (J-1 Visa) and how ASA can help you find a plan just for you that meets J-1 Visa requirements.

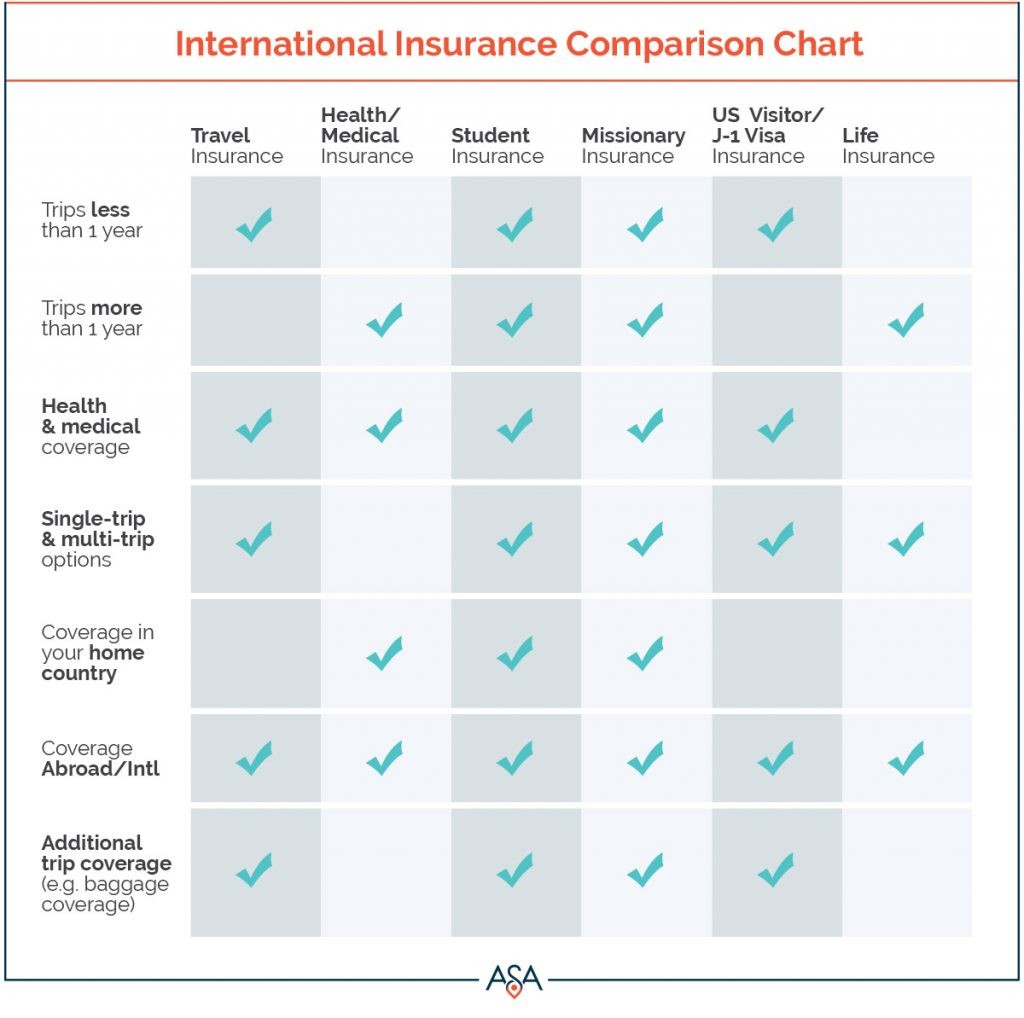

Travel insurance is designed for short-term stays outside your country of residence for less than 12 months. International health insurance is a major medical plan designed to provide more coverage for longer stays abroad that are 1 year or longer. This includes coverage for pre-existing conditions, chronic conditions, preventive care, maternity and renewable coverage, which is not offered through a travel plan. Both types of plans provide coverage for traveling and moving/living abroad.

If your travels are more complex (multiple destinations, varying durations, numerous return trips to/from country of residence), contact us for a free consultation to help you find the right plan.

Premium rates vary due to many factors such as coverage limits, covered benefits, and deductibles. Quality plans can be personalized to meet your needs while also being affordable. Please contact us for a free consultation to help you find the right plan and provide pricing.

If you have a question that isn’t answered above, we’d love the opportunity to answer it for you. We are available to assist you by email, phone, and many other means. Please contact us for more details.